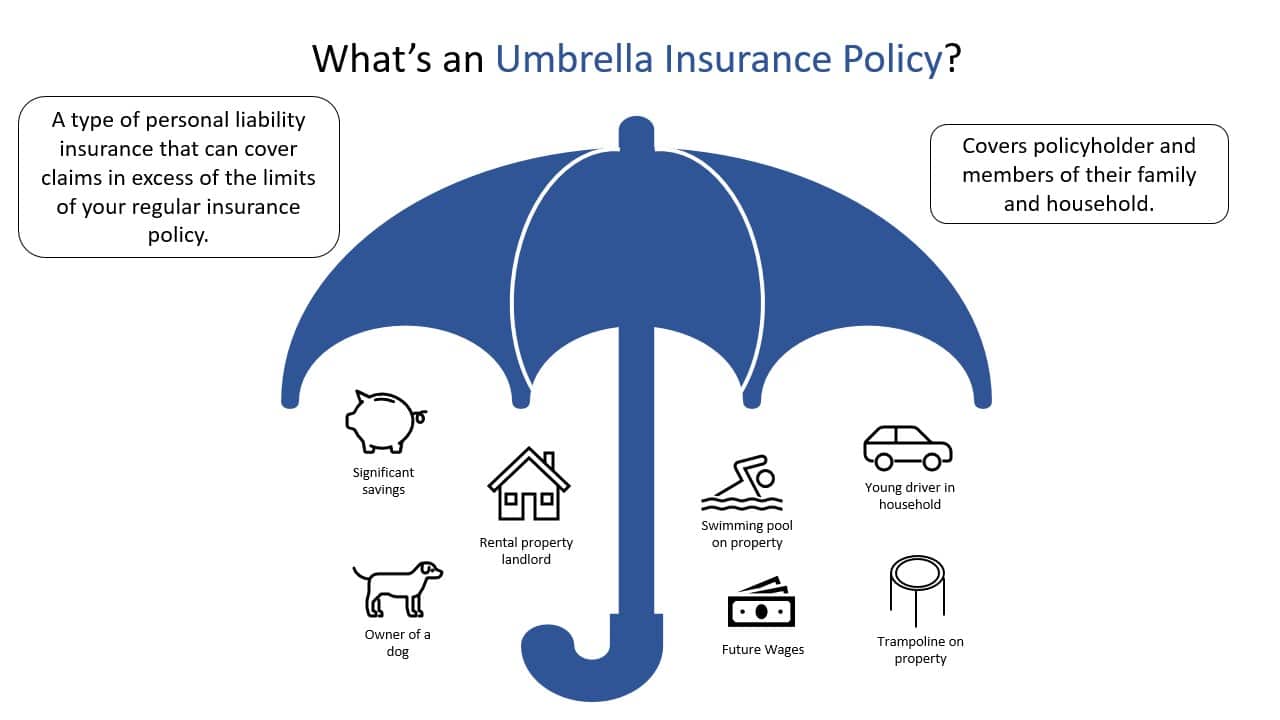

Insurance Umbrella Policy Definition . Below, we'll take a closer look at. what is umbrella insurance? It typically applies when liability exceeds the limits of other. Umbrella insurance is a kind of liability insurance. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. It provides extra liability coverage beyond the limits on.

from assetplanningcorp.com

— an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. what is umbrella insurance? Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. Umbrella insurance is a kind of liability insurance. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. It provides extra liability coverage beyond the limits on. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Below, we'll take a closer look at. — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection.

Time to Grab an Umbrella Insurance Policy?

Insurance Umbrella Policy Definition Below, we'll take a closer look at. what is umbrella insurance? — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. It typically applies when liability exceeds the limits of other. — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. It provides extra liability coverage beyond the limits on. Umbrella insurance is a kind of liability insurance. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. Below, we'll take a closer look at.

From www.blueridgeriskpartners.com

Understanding Umbrella Insurance Blue Ridge Risk Partners Insurance Umbrella Policy Definition It typically applies when liability exceeds the limits of other. what is umbrella insurance? — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. — umbrella insurance is additional liability insurance. Insurance Umbrella Policy Definition.

From marketbusinessnews.com

What is an umbrella policy? Definition and some examples Insurance Umbrella Policy Definition It provides extra liability coverage beyond the limits on. Below, we'll take a closer look at. what is umbrella insurance? — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance. Insurance Umbrella Policy Definition.

From www.youtube.com

Insurance 101 Personal Umbrella Policy YouTube Insurance Umbrella Policy Definition Below, we'll take a closer look at. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance.. Insurance Umbrella Policy Definition.

From www.geico.com

Umbrella Insurance Get an Umbrella Insurance Quote GEICO Insurance Umbrella Policy Definition Umbrella insurance is a kind of liability insurance. what is umbrella insurance? — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. Below, we'll take a closer look at. — an umbrella. Insurance Umbrella Policy Definition.

From www.annuityexpertadvice.com

What Is Umbrella Insurance & How Can It Help You? (2023) Insurance Umbrella Policy Definition — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Umbrella insurance is a kind of liability insurance. It provides extra liability coverage beyond the limits on. what is umbrella insurance? Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. —. Insurance Umbrella Policy Definition.

From www.bbbins.com

What is Umbrella Insurance and Why Do I Need It? Burke, Bogart & Brownell Insurance Umbrella Policy Definition Umbrella insurance is a kind of liability insurance. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. It provides extra liability coverage beyond the limits on. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. It typically applies when liability exceeds. Insurance Umbrella Policy Definition.

From www.allstate.com

What is a Personal Umbrella Policy & When Do You Need It? Allstate Insurance Umbrella Policy Definition It typically applies when liability exceeds the limits of other. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. Below, we'll take a closer look at. — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your. Insurance Umbrella Policy Definition.

From www.rlicorp.com

Personal Umbrella Policy Overview RLI Corp Insurance Umbrella Policy Definition — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. It provides extra liability coverage beyond the limits on. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of. Insurance Umbrella Policy Definition.

From www.financestrategists.com

Umbrella Insurance Policy Importance, Benefits, and Risks Insurance Umbrella Policy Definition what is umbrella insurance? It typically applies when liability exceeds the limits of other. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. It provides extra liability coverage beyond the limits on.. Insurance Umbrella Policy Definition.

From www.annuityexpertadvice.com

What Is Umbrella Insurance & How Can It Help You? (2023) Insurance Umbrella Policy Definition — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. Umbrella insurance is a kind of liability insurance. It provides extra liability coverage beyond. Insurance Umbrella Policy Definition.

From www.mymoneyblog.com

Here Are 11 Reasons We Have An Umbrella Liability Insurance Policy — My Insurance Umbrella Policy Definition Umbrella insurance is a kind of liability insurance. It provides extra liability coverage beyond the limits on. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. what is umbrella insurance? Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. It typically applies when liability. Insurance Umbrella Policy Definition.

From www.slideserve.com

PPT Chapter 24 PowerPoint Presentation, free download ID5581209 Insurance Umbrella Policy Definition — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. Below, we'll take a closer look at. what is umbrella insurance? — umbrella. Insurance Umbrella Policy Definition.

From www.savinjones.com

Do you have Umbrella Insurance? Savin Jones Insurance Agency Insurance Umbrella Policy Definition — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. what is umbrella insurance? Below, we'll take a closer look at. It typically. Insurance Umbrella Policy Definition.

From smartestdollar.com

The Best Commercial Umbrella Insurance for 2023 A Complete Guide Insurance Umbrella Policy Definition Below, we'll take a closer look at. It provides extra liability coverage beyond the limits on. — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. what is umbrella insurance? — umbrella insurance. Insurance Umbrella Policy Definition.

From www.bedelfinancial.com

Umbrella Liability Insurance Insurance Umbrella Policy Definition — umbrella insurance (ui) is a strictly optional policy that acts as a secondary layer of asset protection. what is umbrella insurance? Below, we'll take a closer look at. It provides extra liability coverage beyond the limits on. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of. Insurance Umbrella Policy Definition.

From www.vergeinsurance.com

Understanding Umbrella Insurance Verge Insurance Insurance Umbrella Policy Definition It typically applies when liability exceeds the limits of other. what is umbrella insurance? — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. — umbrella insurance is additional liability insurance that pays beyond the limits of your other insurance. — umbrella insurance (ui) is a strictly. Insurance Umbrella Policy Definition.

From dxodzbioq.blob.core.windows.net

Why Is Umbrella Policy So Important at Ricky Moffatt blog Insurance Umbrella Policy Definition — umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. — an umbrella policy is a form of liability insurance that provides extra liability coverage above the limits of the. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of. Insurance Umbrella Policy Definition.

From www.collidu.com

Umbrella Insurance PowerPoint and Google Slides Template PPT Slides Insurance Umbrella Policy Definition Below, we'll take a closer look at. — umbrella insurance — sometimes called personal liability umbrella insurance — is protection for your savings and other assets. It typically applies when liability exceeds the limits of other. Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. — an umbrella policy is a. Insurance Umbrella Policy Definition.